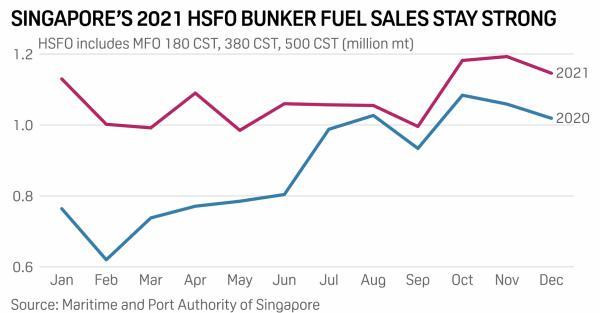

In 2021, although the number of bunkering ships arriving at the port decreased, thanks to the increase of HSFO bunkering’s volume, Singapore's bunker fuel oil’s bunkering volume was close to 50 million tons, hit the second highest record in history.

According to the data released by the Maritime and Port Authority of Singapore (MPA), a total of 39447 ships docked in Singapore for bunkering in 2021, down from 40585 in 2020. The sales volume of VLSFO decreased by 3.56% year-on-year to 32.87 million tons, but the sales volume of HSFO increased sharply by 21.63% to 12.89 million tons. For nine months in 2021, sales of Singapore's HSFO reaches more than 1 million tons a month, compared with only four months in 2020.

A Singapore bunker fuel supplier said: "the transition to alternative bunker fuels, such as LNG, ammonia or hydrogen, and regional competition from North Asian ports, especially Zhoushan, China, may gradually weaken Singapore's VLSFO bunkering capacity. However, due to limited regional supply, Singapore remains the 'most viable HSFO fuel supply location'.

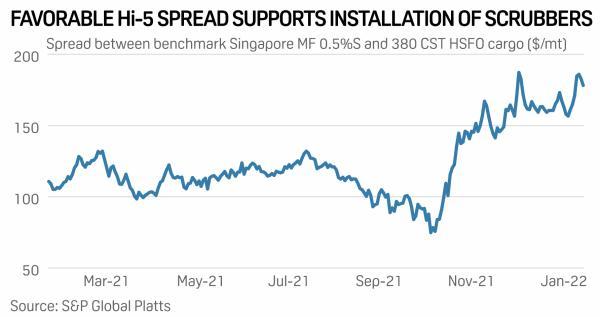

The increase of HSFO bunkering volume is mainly due to the expansion of the oil price difference between high and low sulfur fuel oil (HI-5 price difference). According to Platts’s data, the average price difference between Singapore VLSFO and 380 CST HSFO in 2021 was 119.69 US dollars / ton, higher than 96.91 US dollars / ton in the previous year. Compared with the average value in the second half of 2020, the price difference in the second half of 2021 increased by 82.43%, with an average of 126.17 US dollars / ton.

Recently, Adrian Tolson, director of BLUE Insight, a global research and consulting company, believed in an interview that the price difference between high and low sulfur fuel oil will continue to expand in 2022, and ship owners will continue to prefer to install scrubbers. "The price difference between high and low sulfur fuel oil in Singapore has always been very high, much higher than that in the United States or Europe, but I still think it will expand in 2022."

Adrian Tolson said that the cost of installing scrubbers in new shipbuilding is almost negligible. For large containers, the investment return period of scrubbers is far less than one year, and even the investment return period of refitting scrubbers will not exceed one year. Therefore, large containers ships docked at large ports prefer to install scrubbers. This phenomenon has driven the growth of HSFO in major container ports, with a demand close to 30%.

Fuel suppliers continue to decline

Due to the strict inspection of MPA, some large fuel suppliers and trading companies in Singapore were eliminated due to fraud.

Although some fuel suppliers were forced to withdraw after being found to have violations, some fuel suppliers voluntarily withdrew due to low profits. At present, the number of bunker fuel oil suppliers with marine bunkering licenses in Singapore has been reduced to 41 from more than 50 in September 2017.

Pacific Bunkering Services和A Dot Marine

In 2021, due to the bankruptcy of Hin Leong, a subsidiary under Oon Kuin Lim, the affiliated companies——ocean bunkering services and Hin Leong marine international withdrew from the list of bunker fuel oil suppliers in MPA2021. In addition, Pacific Bunkering Services and A Dot Marine withdrew from MPA's list ofbunker fuel oil suppliers in 2021.

According to market participants, the low profit of downstream delivery of bunker fuel in line with IMO standards has led some suppliers to reduce the barge fleet to optimize costs, and the barge price difference needs at least US $5-8 / ton to offset the operating costs. Platts‘s data show that the price difference between VLSFO delivered in Singapore and bunker fuel delivered at the same level’s terminal, also known as barge price difference, with an average of US $6.61/ton, lower than US $11.29/ton in 2020.

According to the latest data of MPA, after adding two gas oil barges in September, the number of registered fuel oil barges is 209, including one LNG barge. This compares with 210 in March 2021 and 215 in July 2020.

Nevertheless, Singapore remains resilient and continues to be a dominant shipping center. It is also one of the few ports in the world to promote crew changes and minimize supply chain disruption.

The second bunker fuel supplier said demand for delivered VLSFOS is slow in January due to low inventory levels and limited availability of VLSFOS to meet commercial agreement specifications.

Layout clean fuel

Last year, Singapore also sold a total of 50000 tons of LNG as bunker fuel, and began regular ship to ship LNG bunkering business from March.

MPA announced in February that TotalEnergies Marine Fuels (formerly known as Total Marine Fuels) became the third company to obtain a LNG bunkering supplier license in Singapore for a period of five years, starting from January 1, 2022. In a recent white paper, TotalEnergies Marine Fuels said that by 2025, the global LNG fuel market could reach to 10 million tons per year, accounting for 10% of the global fuel market by 2030.

In addition to LNG, Singapore is also considering the development of other alternative fuels, such as hydrogen and ammonia, and the deployment of electric port ships.

In August last year, MPA also announced that the establishment of a global maritime decarbonization center in Singapore to lead the energy transformation journey of the maritime industry.

Source:HyqFocus、Platts Reporter:Evan Liu