On September 4, S&P Global Commodity Insights’ Platts announced the official launch of its daily assessment report for Zhoushan 380 CST high-sulfur fuel oil (HSFO). This marks a significant milestone, as it highlights the growing international attention on Zhoushan’s marine fuel market, further enhancing its global influence.

According to Platts, the introduction of this assessment report is driven by the increasing volumes of 380 CST HSFO delivered in Zhoushan over recent years. Data from S&P Global Commodity Insights shows that Zhoushan’s monthly sales have surpassed those of another major Chinese port, Shanghai.

The new assessment reflects the RMG specifications as defined by the International Organization for Standardization (ISO) in document ISO 8217:2010. It covers cargoes of 500 to 1,500 tons delivered 5-10 days from the date of publication, with market values reported in USD per ton. The assessment is aligned with Singapore’s market close at 5:30 PM Singapore time.

Participants in Platts’ “Market on Close” assessment process, including both buyers and sellers, must specify a three-day delivery window within the assessment period. They can submit bids and offers in various volume ranges, from 500-600 tons up to 1,300-1,500 tons. Buyers are required to declare the exact quantity to sellers within one business day after the transaction, and sellers must provide materials that meet market standards.

As a leading provider of energy information, Platts' daily assessment report offers crucial market data and insights for global energy professionals, traders, and investors. Zhoushan, recognized as a key marine fuel center in Northeast Asia, has increasingly become a focal point in the global energy market due to its pricing and supply-demand dynamics.

Platts first introduced a daily delivery valuation for Zhoushan marine fuel oil on July 1, 2019, covering 0.5% sulfur marine fuel oil (MFZSD00) and 0.1% sulfur marine gas oil (MGZSD00). This new daily assessment for 380 CST HSFO complements these earlier reports.

An industry insider from Zhoushan’s marine fuel market noted that the launch of the 380 CST HSFO daily assessment report signifies the expanding international influence of Zhoushan’s marine fuel market. The report is expected to enhance transparency and market competitiveness in Zhoushan.

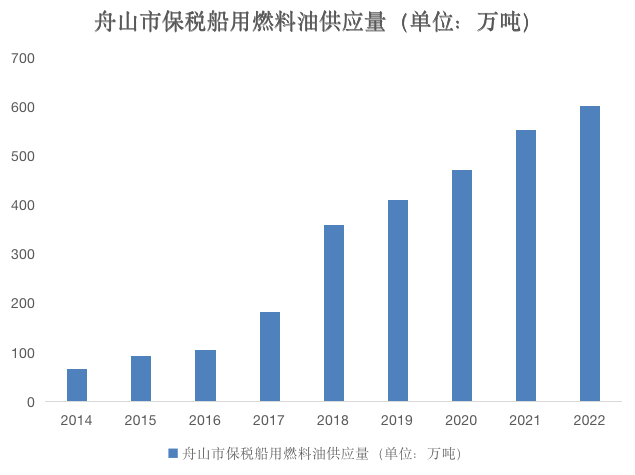

Zhoushan’s journey toward becoming a major player in the global bunkering industry began in 2017 with the announcement of the "China (Zhejiang) Pilot Free Trade Zone Overall Plan," which aimed to establish a bonded fuel oil supply center in Northeast Asia. After years of development, Zhoushan has emerged as the world’s fifth-largest bunkering port. In 2022, Zhoushan’s bonded marine fuel oil direct supply reached 6.02 million tons, reflecting a year-on-year growth of 9.11%. The region now hosts 4 national licensees and 13 local licensees, including five newly licensed companies since 2021, making it China’s most dynamic bonded fuel market.

"For traders, this report will be a crucial tool for seizing opportunities in Zhoushan’s marine fuel market and managing risks. For shipowners, it provides valuable price references when choosing refueling ports," the insider added.

Following the IMO 2020 sulfur cap regulation, only ships equipped with scrubbers can use high-sulfur fuel oil. The significant price difference between high-sulfur and low-sulfur fuel oil, which previously exceeded $250 per ton, has led to substantial profits for ships with scrubbers, thereby increasing the demand for HSFO. According to BIMCO, 399 ships were fitted with scrubbers in 2022, and 17% of new ship orders currently include plans for scrubber installation, as noted by BIMCO shipping analyst Niels Rasmussen.

Source: MarineCircle